Small-cap mutual funds are known for their high growth potential, but have recently seen a sharp fall. From September 2024 to early March 2025, many small-cap funds dropped between 25% to 28%. This decline worried many investors, particularly those who had recently entered the market.

But there’s more to the story.

Key Reasons Behind this Correction

Small-cap companies are usually smaller businesses. They can grow quickly, but they also get hit harder during tough market times. In 2024, factors such as high interest rates, profit booking, global tensions, and expensive valuations led to significant corrections.

In short, the market had gone too high, too fast, so it needed to cool down.

The Regain Momentum

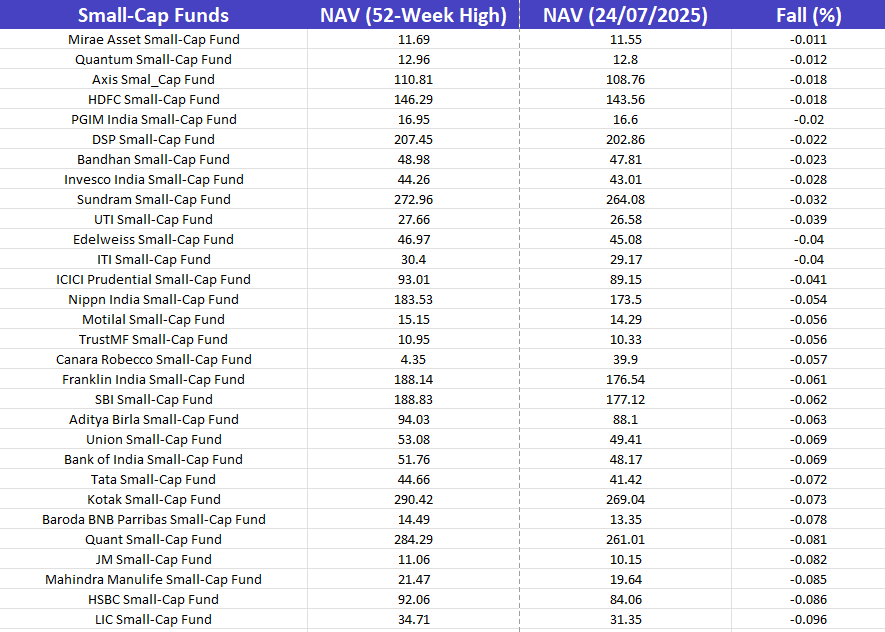

The regain momentum phase for small-cap mutual funds started in early March 2025. This shift occurred as valuations became more attractive, and big investors resumed their purchasing activity. Since then, many small-cap funds have increased by over 20% from their lowest points. Some have even reached new highs.

Investor Perspective

It’s easy to panic when you see red numbers. But investing is like planting a tree; you don’t dig up the seed when it rains.

This fall reminds us of a few key truths:

- Investing is a long-term journey. Ups and downs are normal.

- Rupee Cost Averaging helps when you invest regularly (like SIPs), you buy more units when the market is low and fewer when it’s high. Over time, this averages out your cost.

- Markets test your patience. Staying calm during drops is what makes great investors.

A Bit of Wisdom

Think of market corrections like seasons. Just like winter makes way for spring, market falls often make way for future growth. So don’t fear, just understand them.

Conclusion

Small-cap mutual funds saw a sharp decline between February 2024 and March 2025, causing concern among many investors. However, a clear recovery began in April 2025, offering some relief and a reminder of how markets work in cycles.

The key takeaway is simple but powerful: stay invested, continue your SIP contributions, and focus on the long-term journey rather than short-term noise.

Wealth doesn’t grow overnight. It takes discipline, patience, and faith in the process. Market ups and downs are part of the path, but those who stay the course often come out stronger on the other side.

Stay confident in your journey. Let’s review your investments together.

Disclaimer: Mutual Fund Investments are subject to market risk. Read all scheme-related documents carefully before investing. This article is written by Yogesh Verma using data from AMFI India. It is intended for informational purposes only and does not constitute investment advice. Yogesh Verma is a Registered Mutual Fund Distributor with AMFI (ARN-245560).