While checking my routine work emails this week, a simple headline from a Capitalmind Mutual Fund house caught my eye: “Have you calculated your Human Capital yet?” It made me pause. The question felt different because it wasn’t about markets or returns; it was about the individual behind the investments. Naturally, my curiosity kicked in. I spent some time reading and researching Human Capital Theory, and the more I explored it, the more I realised how closely it connects with the way we take financial risks and expect returns at different stages of life. That is what inspired me to share these insights with you.

Understanding Human Capital Beyond Textbooks

Human capital is the value of all the money you are likely to earn in the future. When someone is 25, his net worth is not just the few lakhs in his bank account or Mutual Fund Portfolio. His real wealth lies in the next 30 or 40 years of his salary, bonuses, incentives, business income, and even side hustles that are still ahead of him.

This future earning power is human capital, and it plays a much bigger role in your financial life than most people realise. It also explains why two people of the same age can have very different comfort levels with risk, and why age-based investing is not just a thumb rule, but a logical outcome of how earning potential changes over time.

Human Capital Theory and the Risk–Return Relationship

Human Capital Theory suggests that risk-taking ability is closely tied to how much earning power you still have ahead of you. When you are younger, your future income acts like a cushion. Even if an investment does not work out as expected, time and future earnings give you the opportunity to recover.

As you grow older, this cushion becomes thinner. Your human capital slowly converts into financial capital, your savings, investments, and assets. At this stage, protecting what you have built becomes more important than chasing aggressive returns. This is where Human Capital Theory quietly shapes sensible investing behaviour.

Why Younger Investors Can Take Higher Risk

From a Human Capital Theory perspective, a young professional’s salary behaves like a long-term, relatively stable asset. This allows younger investors to take higher exposure to growth-oriented investments such as equity

Even market volatility does not hurt as much because time is on their side. Losses can be recovered, and compounding works better over longer periods. This is why long-term wealth creation often begins with higher equity exposure in the early years.

Why Risk Should Reduce With Age

As human capital declines with age, the ability to recover from financial losses also reduces. A major loss close to retirement can permanently impact lifestyle and financial independence.

Human Capital Theory explains why investors naturally move toward stability, income, and capital preservation as they approach later stages of life. The goal shifts from maximising returns to ensuring consistency and peace of mind.

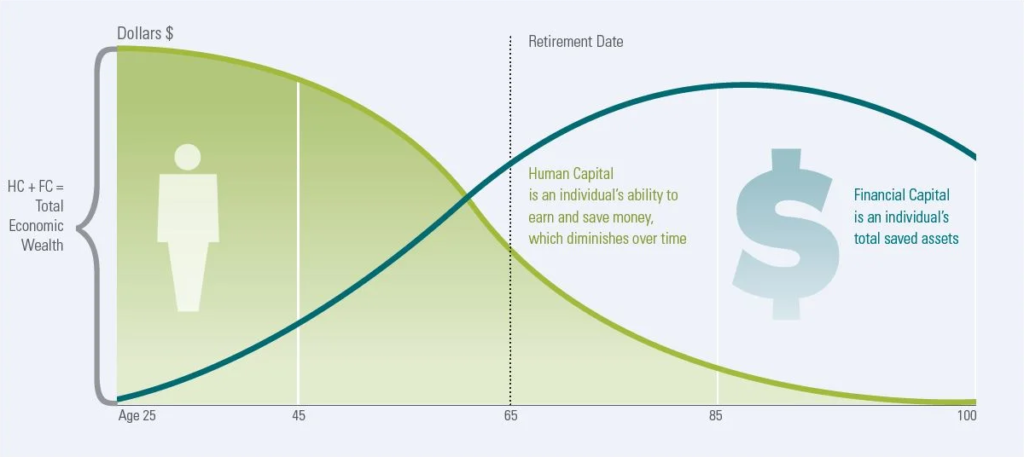

Human Capital vs Financial Capital: A Simple Visual

If you imagine two curves, one represents human capital and the other financial capital. Human capital starts high early in life and gradually declines. Financial capital starts low and grows over time. Risk-taking capacity follows the human capital curve more closely than age itself.

This visual makes Human Capital Theory easy to understand and apply in real-life financial planning.

What This Means for Real-Life Financial Planning

Human Capital Theory reminds us that investing is not just about choosing the right product. It is about aligning investments with earning stability, career stage, health, and future income visibility.

This is also why a 30-year-old entrepreneur and a 30-year-old salaried professional may need very different investment strategies. Age matters, but human capital matters more.

Final Thought

Human Capital Theory gives a simple and logical explanation for how risk and returns should evolve over a lifetime. It shows why young investors can afford to take risks, why mid-career investors need balance, and why capital protection becomes critical later on.

When you align your investments with your human capital, your decisions become more thoughtful, disciplined, and aligned with long-term goals.

How to Apply Human Capital Theory to Your Financial Planning

Human Capital Theory reminds us that investing should evolve as our life and earning capacity change. What works in your 20s may not be suitable in your 40s or 50s. The key is to align your investments with your remaining earning potential, career stability, and long-term goals, rather than following generic age-based rules.

A thoughtful review of your financial plan, keeping your human capital in mind, can help you take the right amount of risk at the right time. When investments are aligned with where you are in life, financial decisions feel more confident and far less stressful.

If you would like to assess your investment strategy through the lens of Human Capital Theory and align it with your personal goals, a structured discussion can help bring clarity and direction.

Also Read: The Turtle Theory in Personal Finance

Disclaimer: This article is written by Yogesh Verma for general awareness and educational purposes only and should not be construed as investment advice, recommendation, or solicitation. Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully before investing. Investment decisions should be made based on individual financial goals, risk appetite, and suitability. Past performance is not indicative of future results.

Yogesh Verma is an AMFI Registered Mutual Fund Distributor (ARN-245560).

[…] Also Read: 👉 Human Capital Theory & Financial Risk: An Age-Based Perspective […]