I have seen many investors worry about how to build wealth without stress. Interestingly, some of the best results I’ve seen did not come from complex strategies; they came from simple discipline. The 15-15-15 rule in mutual funds is one such powerful yet simple approach that has helped many people quietly build wealth over time.

What Is the 15-15-15 Rule in Mutual Funds?

The idea is very straightforward.

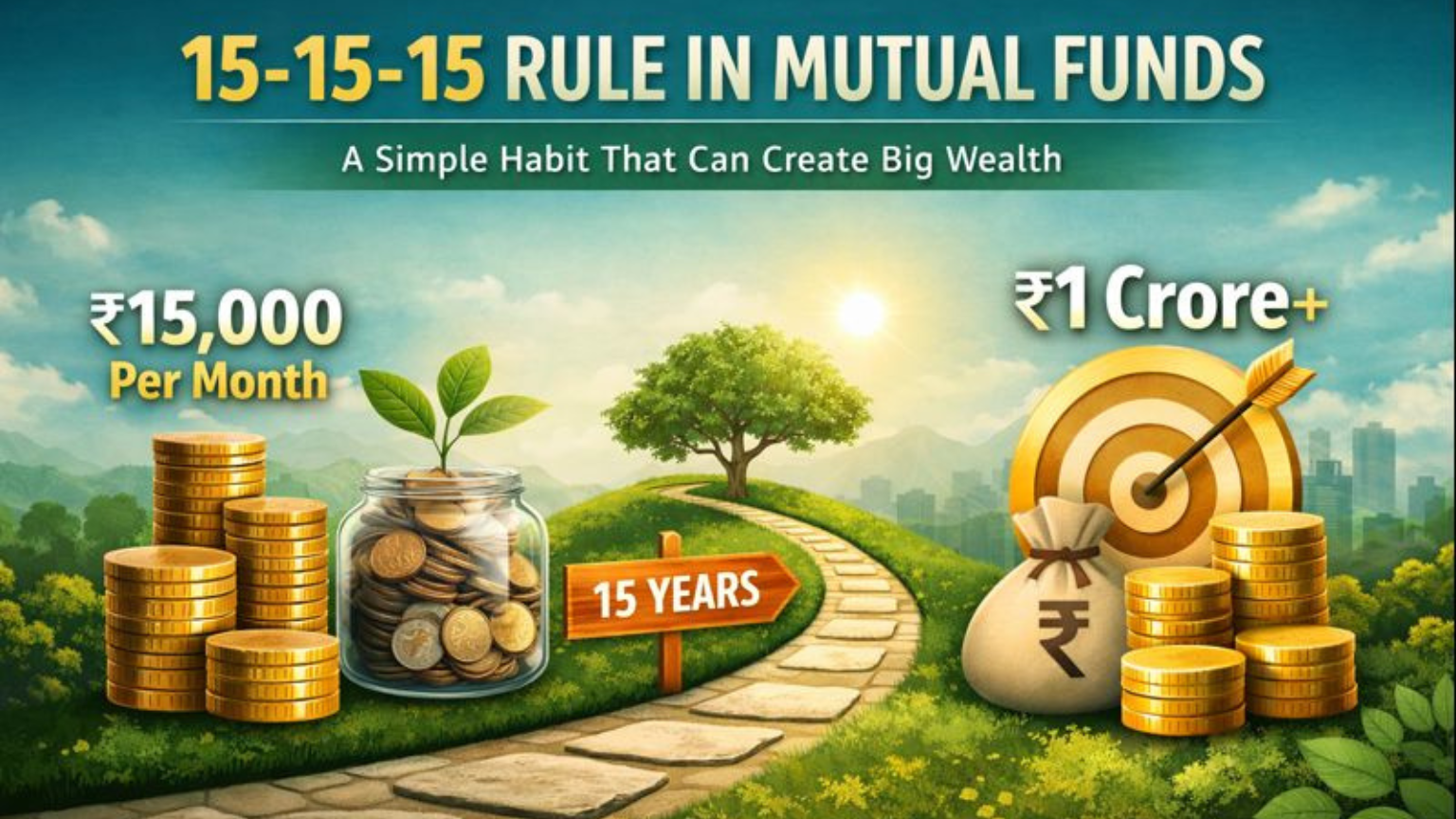

If someone invests ₹15,000 every month, continues this for 15 years, and the investments grow at an assumed 15% annual return, the wealth created can be close to ₹1 crore or more.

There is no rocket science behind it.

No aggressive trading, no chasing hot stocks, no timing the market.

Just patience, SIP discipline, and the power of compounding are doing the heavy lifting.

How Does the 15-15-15 Rule Build Wealth?

Over the span of 15 years, if someone invests ₹15,000 every month, the actual amount invested is approximately ₹27 lakh.

What surprises most people is how that ₹27 lakh can grow into ₹1 crore.

That difference is created purely by compounding money earning returns, and those returns further earn returns over time. I have seen many investors who did nothing more than stay committed to their SIPs and eventually found themselves sitting on meaningful wealth.

That is why the 15-15-15 rule in mutual funds is not a marketing concept; it is a disciplined wealth-building habit.

Why This Rule Matters in Real Life

Most people assume wealth is built only through high income, business success, or luck. But in reality, I have watched investors with ordinary income build strong financial confidence simply because they:

- Started investing early

- Stayed patient

- Did not break their SIP discipline

The 15-15-15 rule teaches exactly that.

It gives direction, gives structure, and removes unnecessary pressure from investing.

Is 15% Return Guaranteed?

No, it is not. Markets move up and down. There will be phases of correction, volatility, and uncertainty. But historically, equity markets have rewarded long-term investors.

The lesson is simple:

- Stay invested

- Avoid emotional decisions

- Let time and compounding work

The 15-15-15 rule in mutual funds is a reminder that time in the market matters far more than timing the market.

Who Can Benefit From the 15-15-15 Rule?

This approach is especially useful for:

- Young professionals beginning their financial journey

- Families planning long-term wealth

- Parents thinking about their children’s future

- Anyone who wants financial stability without stress

I have personally seen people achieve goals they once thought were difficult, simply because they stayed consistent.

A Simple Thought to Remember

Building wealth is like nurturing a plant.

You water it regularly, protect it, and give it time to grow.

You do not pull it every few weeks to see if it has grown.

The 15-15-15 rule in mutual funds works the same way as steady care, patience, and time reward you beautifully.

Final Thoughts

The 15-15-15 rule is not about promising big returns. It is about showing what disciplined investing can do over time. Whether you are at the start of your career or already on your way, the best time to build good financial habits is today.

If this approach resonates with you, it might be the right time to take the next step. Wealth is rarely created by sudden decisions; it is built quietly through clarity, consistency, and the right guidance.

If you want to explore how the 15-15-15 rule can fit into your personal financial goals, I would be happy to sit with you, understand your situation, and help you create a plan that feels practical and comfortable, not overwhelming.

Also Read: The 20/4/10 Rule: A Smarter Way to Buy Your Dream Car

Disclaimer: This article is written by Yogesh Verma for general awareness and educational purposes only and should not be construed as investment advice, recommendation, or solicitation. Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully before investing. Investment decisions should be made based on individual financial goals, risk appetite, and suitability. Past performance is not indicative of future results.

Yogesh Verma is an AMFI Registered Mutual Fund Distributor (ARN-245560).